India’s mutual fund industry has witnessed more than just AUM growth over the last decade — it has seen a transformation in investor behavior, portfolio construction, and access routes.

👥 Rise of the Retail Investor

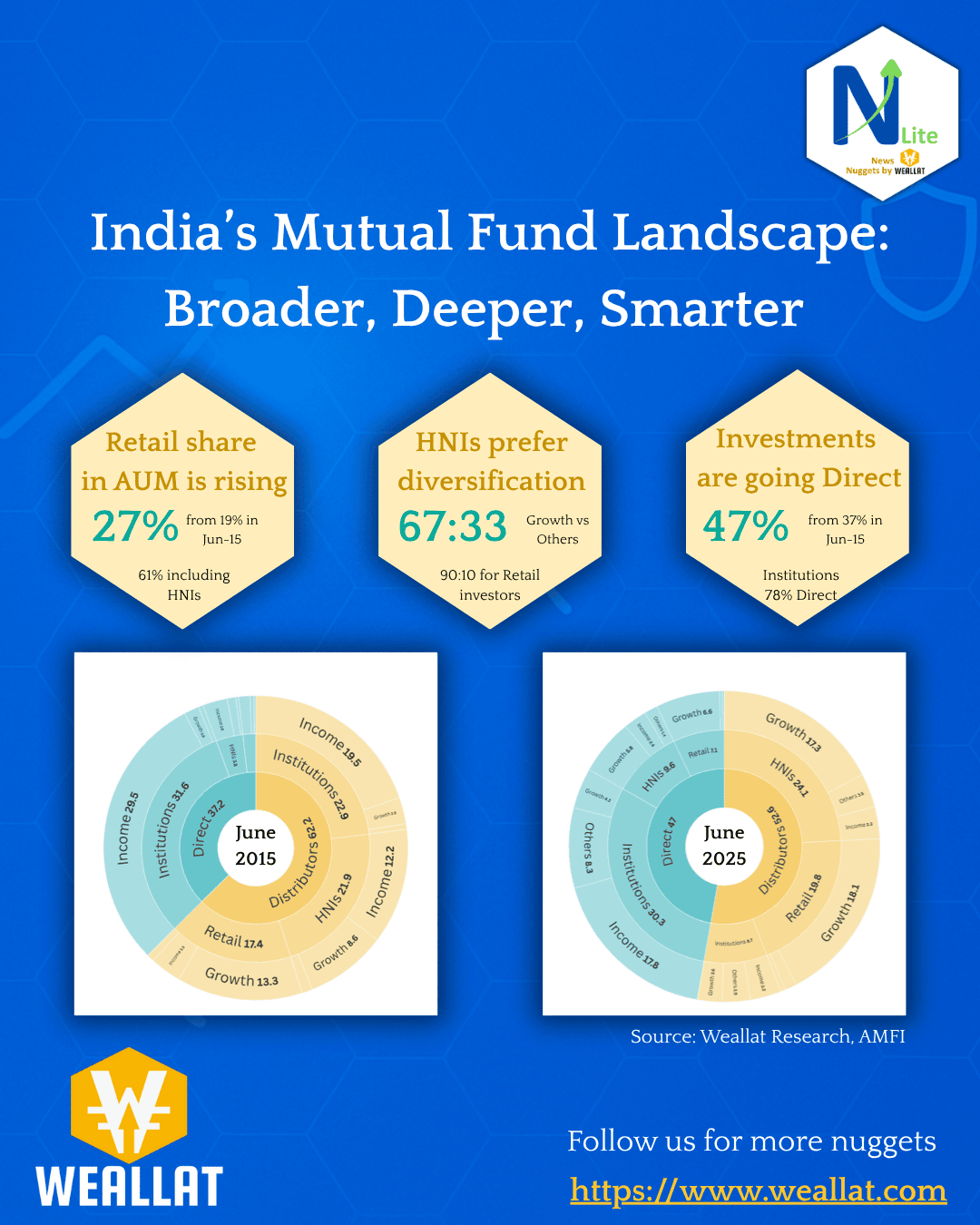

Retail participation in MF AUM has climbed from 19% in 2015 to 27% in 2025, signaling stronger adoption of market-linked products for long-term wealth creation. Including HNIs, individual investors now account for 61% of total AUM, up from 45% in 2015.

📊 Diversification vs Equity Bias

While HNIs are diversifying their exposure (only 67% in growth schemes), retail investors remain heavily growth-oriented, with over 90% of their portfolios in equity funds — reflecting both optimism and opportunity awareness.

🛒 Distribution Model Maturity

The path to investing is changing. Direct investments now account for 47% of AUM, up from 37% in 2015.

- For institutions, 78% is direct

- For retail/HNI, 72%+ still comes via distributors

This reflects increasing digital comfort and cost-conscious investing — especially among larger and institutional players.

💡 Final Thought

India’s mutual fund market is broadening its base, deepening its reach, and smartening its channels. The future lies in greater awareness, digital access, and customized portfolio strategies for every investor segment.