Fixed income is evolving — and it’s no longer just about fixed deposits.

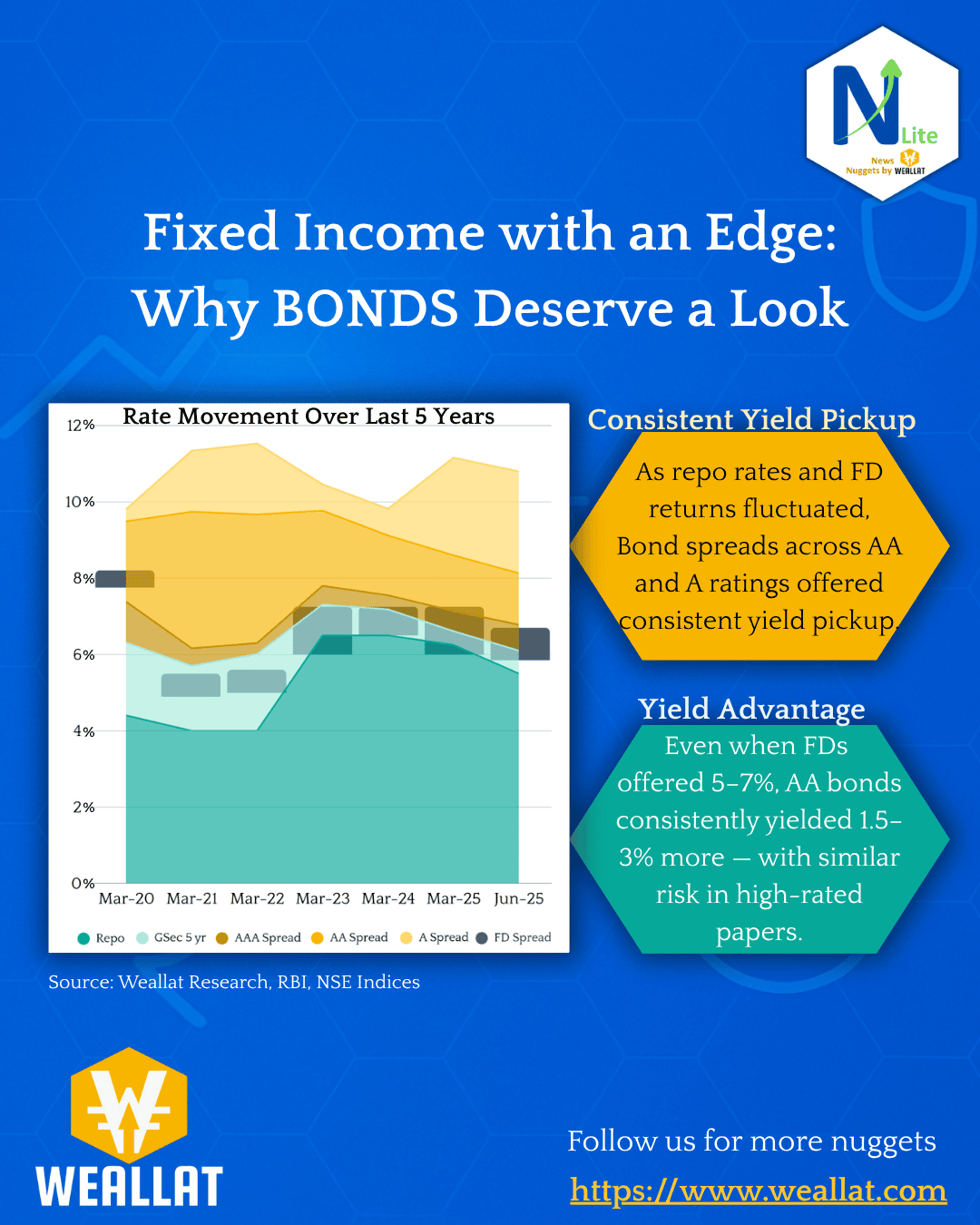

Over the last 5 years, Indian investors relying solely on FDs may have missed out on meaningful yield enhancement. Data shows that AA and A-rated bonds consistently delivered 1.5–3% higher returns than fixed deposits, without significantly increasing credit risk.

📊 What's Driving the Edge?

- Credit spreads across rated bonds (AAA, AA, A) offered a steady yield premium

- While FD rates fluctuated with repo, bonds offered stability, tradability, and market-linked pricing

- AAA bonds outperformed GSecs in key periods — offering better returns

🧠 Why This Matters:

- Bonds offer customization across tenure, credit, and structure

- They provide exit flexibility that locked-in FDs do not

- With digital platforms, bonds are now more accessible to retail investors