When investing in equity mutual funds, most investors focus on performance metrics — but few account for how much they’re paying to stay invested.

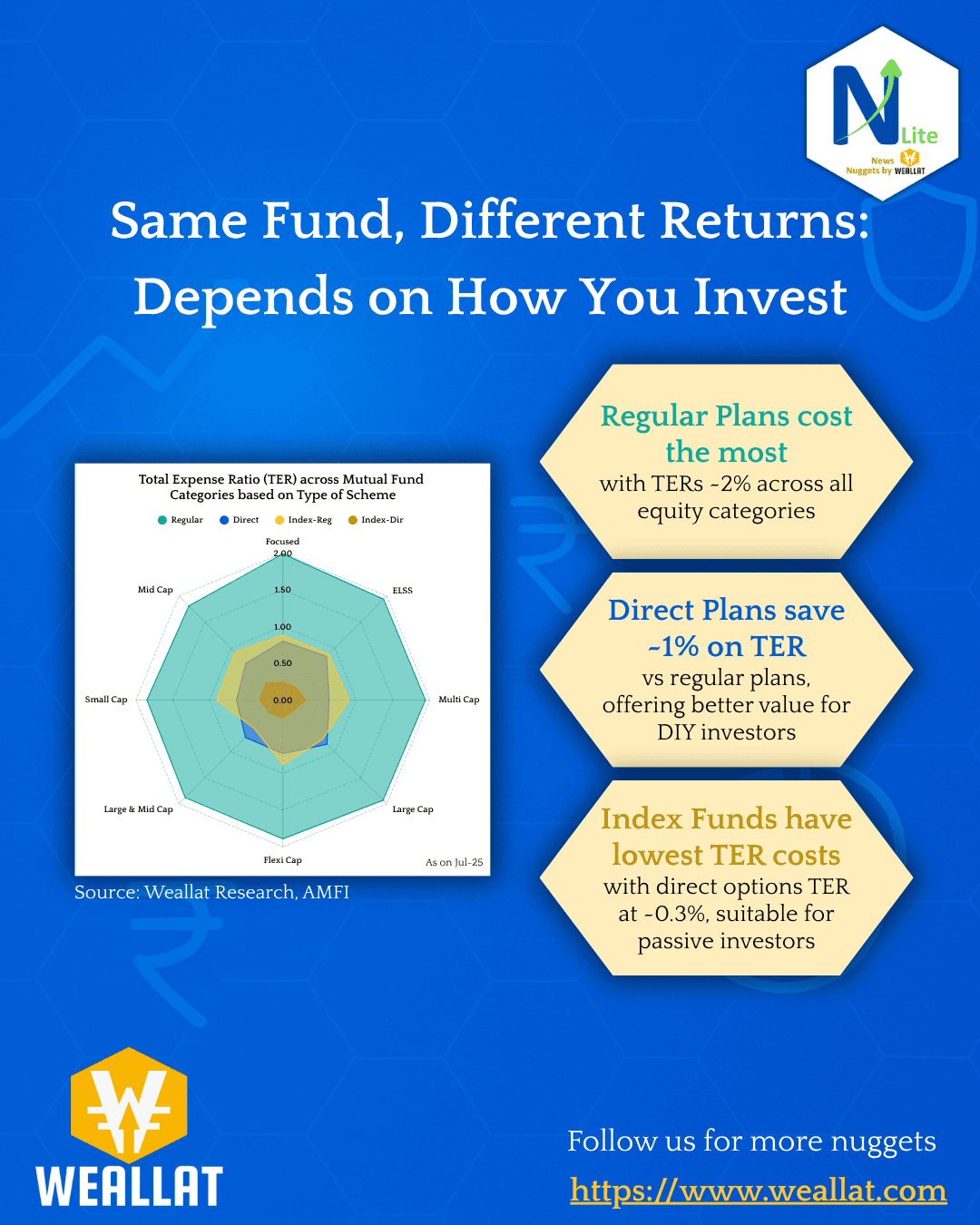

A radar analysis across fund categories reveals:

- Regular plans charge ~2% TER, consistently across categories

- Direct plans save ~1%, removing distributor commissions

- Index funds (Direct) charge as low as 0.3–0.5%, making them ideal for cost-conscious passive investors

Over a 10–15 year horizon, these small differences snowball into significantly different outcomes — purely based on the route you choose.

Choose your investment vehicle or route not just by returns, but by efficiency.